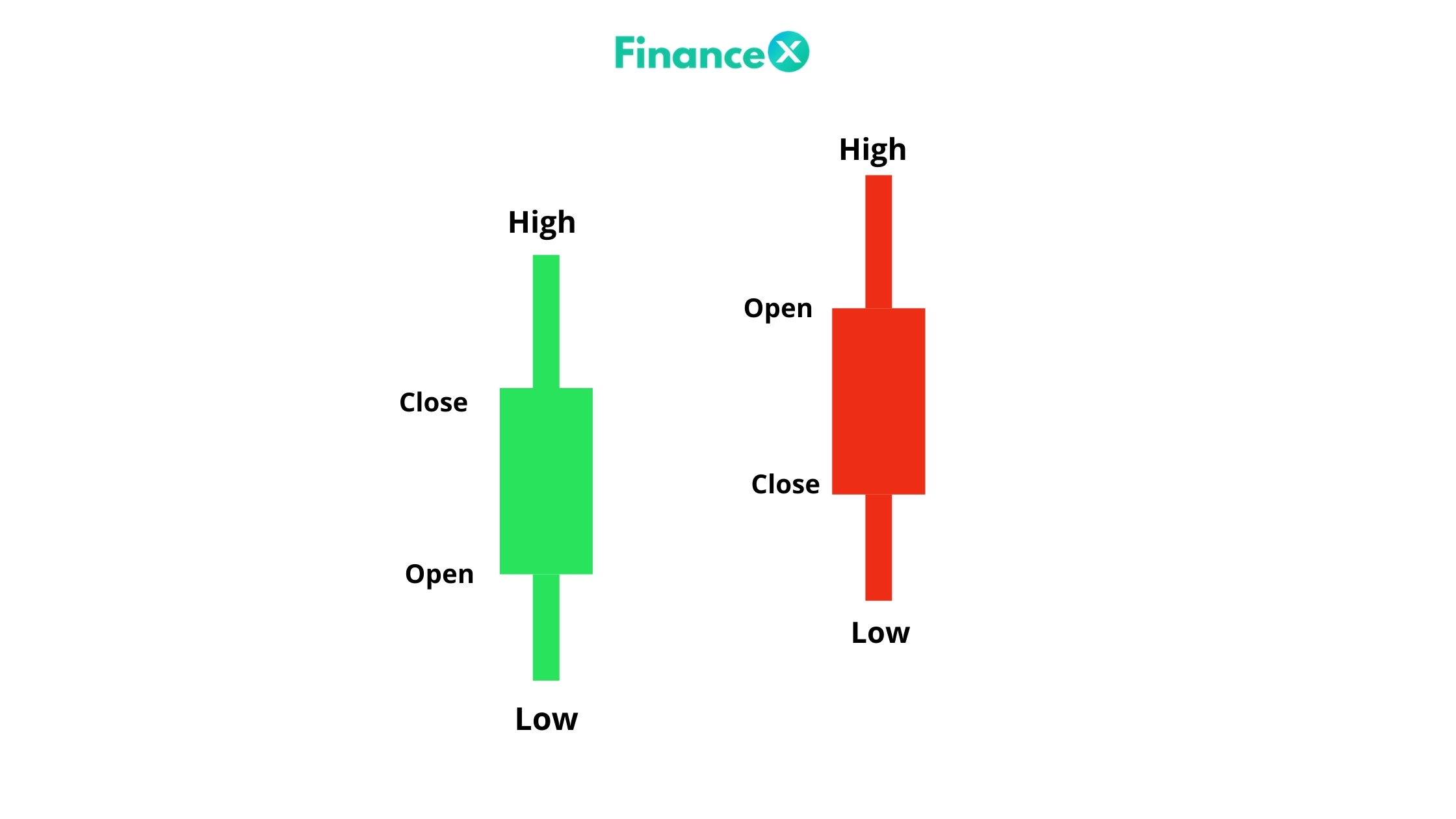

What Are Candlesticks In Investing . The doji candlestick pattern is a single candlestick pattern that. However, unlike the ohlc bar. Discover 16 of the most common candlestick patterns and how you can use them to identify trading. A candlestick chart, like a bar chart, shows the opening, closing, and highs and lows of the day’s range. These charts show the open, high, low, and closing in any chosen time interval. In the absence of a crystal ball, candlestick patterns are the next best thing. It displays the high, low, open, and closing prices of a security for a specific period. Last updated 23 november, 2021. Candlesticks are price charts that display four key levels in price per specified unit of time. The rectangular real body, or just body,. Candlestick patterns are used to predict the future direction of price movement. Some patterns simply reflect indecision in the market. A candlestick is a type of price chart used in technical analysis. A daily candlestick represents a market’s opening, high, low, and closing (ohlc) prices.

from financex.in

The doji candlestick pattern is a single candlestick pattern that. Candlesticks are price charts that display four key levels in price per specified unit of time. It displays the high, low, open, and closing prices of a security for a specific period. These charts show the open, high, low, and closing in any chosen time interval. A candlestick is a type of price chart used in technical analysis. Candlestick patterns are used to predict the future direction of price movement. Discover 16 of the most common candlestick patterns and how you can use them to identify trading. In the absence of a crystal ball, candlestick patterns are the next best thing. Some patterns simply reflect indecision in the market. The rectangular real body, or just body,.

How to Read Candlestick Charts for Beginners? 2021

What Are Candlesticks In Investing However, unlike the ohlc bar. Some patterns simply reflect indecision in the market. Discover 16 of the most common candlestick patterns and how you can use them to identify trading. The doji candlestick pattern is a single candlestick pattern that. Candlestick patterns are used to predict the future direction of price movement. However, unlike the ohlc bar. Last updated 23 november, 2021. These charts show the open, high, low, and closing in any chosen time interval. In the absence of a crystal ball, candlestick patterns are the next best thing. A candlestick is a type of price chart used in technical analysis. It displays the high, low, open, and closing prices of a security for a specific period. The rectangular real body, or just body,. Candlesticks are price charts that display four key levels in price per specified unit of time. A daily candlestick represents a market’s opening, high, low, and closing (ohlc) prices. A candlestick chart, like a bar chart, shows the opening, closing, and highs and lows of the day’s range.

From candlestickstrading.blogspot.com

All Candlestick Chart Patterns Candle Stick Trading Pattern What Are Candlesticks In Investing These charts show the open, high, low, and closing in any chosen time interval. In the absence of a crystal ball, candlestick patterns are the next best thing. It displays the high, low, open, and closing prices of a security for a specific period. Last updated 23 november, 2021. Candlesticks are price charts that display four key levels in price. What Are Candlesticks In Investing.

From www.andrewstradingchannel.com

Candlestick Patterns Explained with Examples NEED TO KNOW! What Are Candlesticks In Investing However, unlike the ohlc bar. Some patterns simply reflect indecision in the market. The rectangular real body, or just body,. It displays the high, low, open, and closing prices of a security for a specific period. A candlestick is a type of price chart used in technical analysis. A candlestick chart, like a bar chart, shows the opening, closing, and. What Are Candlesticks In Investing.

From www.aiophotoz.com

Candlestick Patterns Every Trader Should Know Part 1 Images and What Are Candlesticks In Investing Candlestick patterns are used to predict the future direction of price movement. A candlestick chart, like a bar chart, shows the opening, closing, and highs and lows of the day’s range. A daily candlestick represents a market’s opening, high, low, and closing (ohlc) prices. The rectangular real body, or just body,. Last updated 23 november, 2021. Candlesticks are price charts. What Are Candlesticks In Investing.

From excellenceassured.com

The best trading candlestick patterns What Are Candlesticks In Investing In the absence of a crystal ball, candlestick patterns are the next best thing. A daily candlestick represents a market’s opening, high, low, and closing (ohlc) prices. A candlestick chart, like a bar chart, shows the opening, closing, and highs and lows of the day’s range. Discover 16 of the most common candlestick patterns and how you can use them. What Are Candlesticks In Investing.

From www.pinterest.com.mx

Candlestick Cheat Sheet Signals Trading charts, Forex trading quotes What Are Candlesticks In Investing Candlestick patterns are used to predict the future direction of price movement. Candlesticks are price charts that display four key levels in price per specified unit of time. A candlestick is a type of price chart used in technical analysis. In the absence of a crystal ball, candlestick patterns are the next best thing. A daily candlestick represents a market’s. What Are Candlesticks In Investing.

From www.babezdoor.com

Basic Candlestick Patterns Trendy Stock Charts Candlestick Patterns What Are Candlesticks In Investing A candlestick chart, like a bar chart, shows the opening, closing, and highs and lows of the day’s range. Last updated 23 november, 2021. However, unlike the ohlc bar. A candlestick is a type of price chart used in technical analysis. Candlestick patterns are used to predict the future direction of price movement. Candlesticks are price charts that display four. What Are Candlesticks In Investing.

From therobusttrader.com

Candlestick Guide How to Read Candlesticks and Chart Patterns What Are Candlesticks In Investing However, unlike the ohlc bar. Candlestick patterns are used to predict the future direction of price movement. In the absence of a crystal ball, candlestick patterns are the next best thing. Some patterns simply reflect indecision in the market. The doji candlestick pattern is a single candlestick pattern that. Discover 16 of the most common candlestick patterns and how you. What Are Candlesticks In Investing.

From www.investopedia.com

Understanding a Candlestick Chart What Are Candlesticks In Investing These charts show the open, high, low, and closing in any chosen time interval. The rectangular real body, or just body,. However, unlike the ohlc bar. A candlestick is a type of price chart used in technical analysis. A daily candlestick represents a market’s opening, high, low, and closing (ohlc) prices. Some patterns simply reflect indecision in the market. In. What Are Candlesticks In Investing.

From agrohon.weebly.com

Candlestick pattern cheat sheet pdf agrohon What Are Candlesticks In Investing Candlestick patterns are used to predict the future direction of price movement. These charts show the open, high, low, and closing in any chosen time interval. The doji candlestick pattern is a single candlestick pattern that. A daily candlestick represents a market’s opening, high, low, and closing (ohlc) prices. It displays the high, low, open, and closing prices of a. What Are Candlesticks In Investing.

From financex.in

How to Read Candlestick Charts for Beginners? 2021 What Are Candlesticks In Investing Last updated 23 november, 2021. It displays the high, low, open, and closing prices of a security for a specific period. Candlestick patterns are used to predict the future direction of price movement. Some patterns simply reflect indecision in the market. The doji candlestick pattern is a single candlestick pattern that. The rectangular real body, or just body,. In the. What Are Candlesticks In Investing.

From www.pinterest.com

Candlestick Reversal Patterns Stock options trading, Trading charts What Are Candlesticks In Investing These charts show the open, high, low, and closing in any chosen time interval. Candlesticks are price charts that display four key levels in price per specified unit of time. It displays the high, low, open, and closing prices of a security for a specific period. Some patterns simply reflect indecision in the market. A candlestick chart, like a bar. What Are Candlesticks In Investing.

From www.pinterest.com

A hammer candlestick as a reversal in a downtrend Candlestick chart What Are Candlesticks In Investing These charts show the open, high, low, and closing in any chosen time interval. The doji candlestick pattern is a single candlestick pattern that. However, unlike the ohlc bar. A daily candlestick represents a market’s opening, high, low, and closing (ohlc) prices. A candlestick chart, like a bar chart, shows the opening, closing, and highs and lows of the day’s. What Are Candlesticks In Investing.

From www.pinterest.com.au

Candlestick Cheat Sheet Candlestick chart patterns, Candlestick chart What Are Candlesticks In Investing These charts show the open, high, low, and closing in any chosen time interval. In the absence of a crystal ball, candlestick patterns are the next best thing. A candlestick chart, like a bar chart, shows the opening, closing, and highs and lows of the day’s range. It displays the high, low, open, and closing prices of a security for. What Are Candlesticks In Investing.

From www.tradingsim.com

Price Action Trading Strategies 6 Patterns that Work TradingSim What Are Candlesticks In Investing However, unlike the ohlc bar. A daily candlestick represents a market’s opening, high, low, and closing (ohlc) prices. These charts show the open, high, low, and closing in any chosen time interval. The rectangular real body, or just body,. It displays the high, low, open, and closing prices of a security for a specific period. Some patterns simply reflect indecision. What Are Candlesticks In Investing.

From www.investopedia.com

Different Colored Candlesticks in Candlestick Charting What Are Candlesticks In Investing These charts show the open, high, low, and closing in any chosen time interval. The doji candlestick pattern is a single candlestick pattern that. Some patterns simply reflect indecision in the market. However, unlike the ohlc bar. A candlestick is a type of price chart used in technical analysis. It displays the high, low, open, and closing prices of a. What Are Candlesticks In Investing.

From candlestickstrading.blogspot.com

Bullish Rising Three Methods Candlestick Candle Stick Trading Pattern What Are Candlesticks In Investing These charts show the open, high, low, and closing in any chosen time interval. Candlestick patterns are used to predict the future direction of price movement. It displays the high, low, open, and closing prices of a security for a specific period. The rectangular real body, or just body,. Discover 16 of the most common candlestick patterns and how you. What Are Candlesticks In Investing.

From mungfali.com

Strong Reversal Candlestick Patterns What Are Candlesticks In Investing Candlestick patterns are used to predict the future direction of price movement. The rectangular real body, or just body,. Last updated 23 november, 2021. In the absence of a crystal ball, candlestick patterns are the next best thing. Discover 16 of the most common candlestick patterns and how you can use them to identify trading. A candlestick chart, like a. What Are Candlesticks In Investing.

From www.pinterest.com

All types of candle stick you should know. If you want to trade Forex What Are Candlesticks In Investing These charts show the open, high, low, and closing in any chosen time interval. Some patterns simply reflect indecision in the market. In the absence of a crystal ball, candlestick patterns are the next best thing. It displays the high, low, open, and closing prices of a security for a specific period. Discover 16 of the most common candlestick patterns. What Are Candlesticks In Investing.